When you finally pay, the IRS will first apply the payment to the tax you owe, then to any penalty, and then to any interest. Note that special filing deadlines apply in certain instances. Request for extension of time to file April 18, 2022. However, the reasons for your lack of funds may meet reasonable cause criteria for the failure-to-pay penalty. Filing due dates for your 2021 personal income tax return. Simply not having the money, in and of itself, is not reasonable cause for the failure to pay taxes on time. Other reason that establishes that you used "all ordinary business care and prudence" to meet your federal tax obligations but were nevertheless unable to do so.Death, serious illness, incapacitation or unavoidable absence of you or a member of your immediate family or.Fire, casualty, natural disaster or other disturbances.The IRS will consider any sound reason for failing to pay your taxes on time, including: Reasonable cause is based on all the facts and circumstances in your situation.

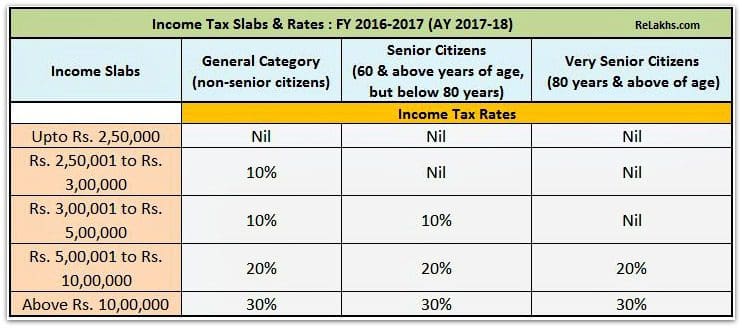

You won't have to pay the penalty if you can show "reasonable cause" for the failure to pay on time. However, the penalty is only 0.25% for each month, or part of a month, in which an IRS installment agreement is in effect. The rate jumps to 1% ten days after the IRS issues a final notice of intent to levy or seize property. The penalty is capped at 25% of the amount owed. If you didn't pay the tax you owe on time, the IRS will impose a late payment penalty equal to 0.5% of the tax owed after April 18 for each month, or part of a month, the tax remains unpaid (after April 19 for people who live in Maine and Massachusetts). The deadline for filing and payment of the Annual Income Tax Return, for the calendar year ending December 31, 2016, is on Ap(Monday) since Apfalls on a Saturday which is also a holiday/non-working day.

0 kommentar(er)

0 kommentar(er)